Renovations of the Reade Business Center have made the finance lab operational, while other aspects are still in progress.

The Reade Center renovations began the day after graduation May 15. Ron Sutherland, special assistant to the president, is the project manager, and, with the help of a team of individuals, completed the first set of renovations before the start of the 2021–2022 academic year.

The most impactful piece of this renovation project is the finance lab in Reade 116. It now features 12 Bloomberg terminals, an internet-based technology that curates finance data and allows for data analysis.

“It’s truly unfathomable the amount of information they host,” said Justin Henegar, assistant professor of finance. “We have access to the same tools that BlackRock and Capital Group (are) using to manage billions, if not trillions of dollars. Our students are getting that education.”

In total, the Bloomberg terminals cost $75,000 and, with the help of a donor, are in the process of being paid off. Christopher Kellner, assistant professor of finance, is in his first year at Taylor and said the end goal is to fund all the terminals by the endowment fund. Kellner teaches applied portfolio risk management in the lab, and several other classes including sport finance are offered in Reade 116.

“That was part of what attracted me here (Taylor), was the fact that I could see an investment going on in the department, and I knew that finance was a signature program that they’re investing in,” Kellner said.

As part of extracurriculars, a club called Investing Excellence (IXL) meets in the lab every Tuesday night at 8 p.m. Members participate in a stock trading challenge alongside universities from around the globe and any Taylor student can join. Out of 491 participating universities, Taylor ranks in the top 20 schools, Kellner said.

Senior Avery Mozingo is a double major in accounting and finance. Most of his classes will be and are currently being taught in the lab, such as financial planning. Mozingo said he has limited experience using Bloomberg but likes the organization and intuitiveness of the data technology.

As a CREW tour guide for admissions at Taylor, Mozingo said he observed firsthand how big of an attraction the new lab is for prospective finance majors.

“(The Bloomberg resource is) the one thing that I now have for business majors in general,” Mozingo said. “That’s something so unique to Taylor. Honestly, in the long run that’s going to be a draw for students, especially those interested in investing (in) stocks.”

Business students can use Bloomberg in an applied course covering equity analysis and portfolio management called the Endowment Team. Henegar said students are currently managing approximately $5.5 million of Taylor’s endowment. While a small portion in the grand scheme of things, it is a real-world investment process and allows students to learn when stocks are to be included in a portfolio or left alone.

A collaboration room, conference room, extended hallway space and finance lab are among the areas of repurposing in Reade.

Beginning with the collaboration room, it seats six–eight students and can be utilized for team projects, innovation and professional development, according to Jody Hirschy, associate professor of marketing.

The conference room seats 10–12 and is intended as a space for professional meetings, such as the Taylor Business Advisory Council’s annual meeting which took place Oct. 8.

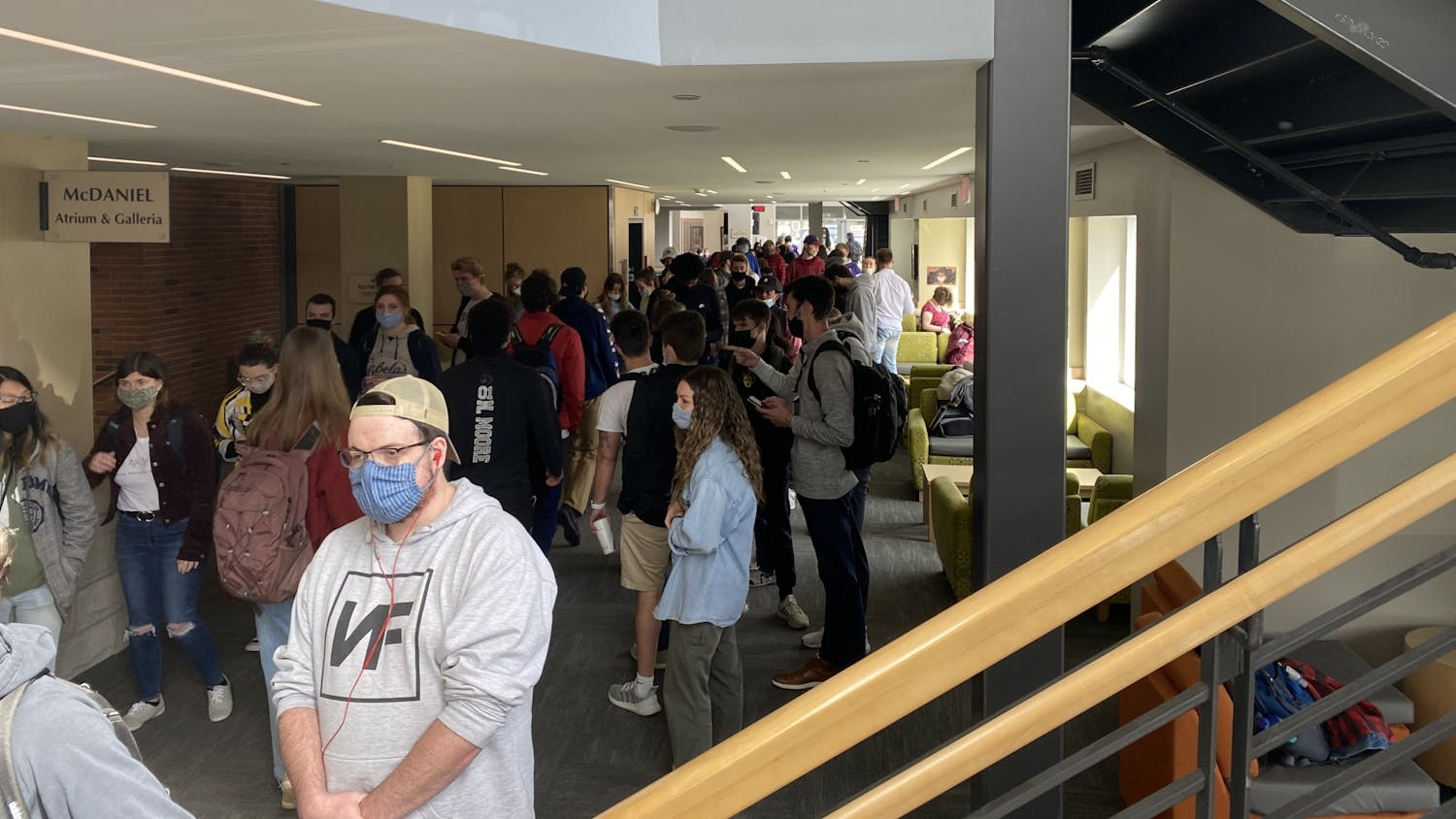

As for the hallway weaving past these rooms, additions of furniture will promote community among all business majors and welcome prospective students.

Aesthetically speaking, new carpeting and paint was added to the northeast wing.

Hirschy said COVID-19 has caused furniture shipment delays, but the renovation team hopes to have the project finished by the end of this fall semester.