By David Adams | Echo

I'm graduating in 22 days, and I have student loans totaling $19,913.

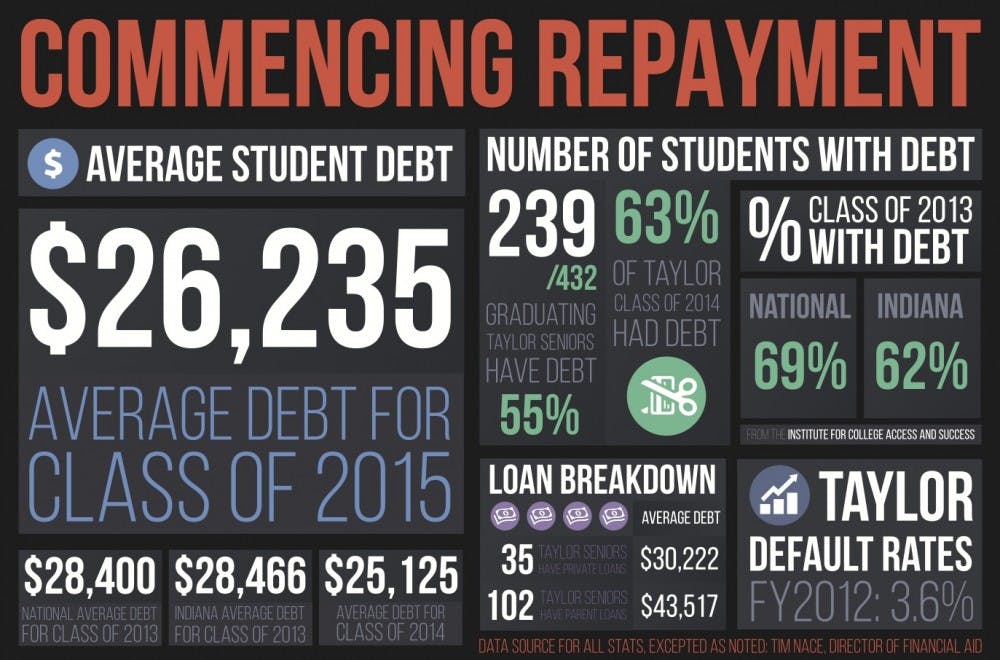

The class of 2015's average debt is $26,235, according to Director of Financial Aid Tim Nace. That's a few thousand dollars less than the national average for the class of 2013, the most recent data compiled by The Institute for College Access and Success (TICAS).

Debt on this scale might be daunting-mine certainly gives me pause. But in the 22 days before we cross the commencement stage, let's take a moment to examine our debt, class of 2015, so that we can turn our tassels with confidence.

-

Student debt has become a national conversation in the past few years. TICAS' report on the class of 2013's debt "shows that debt levels continue to rise." Nearly seven in 10 students in the class of 2013 graduated with debt, according to the study, which is based on information volunteered by more than half of U.S. public and private nonprofit colleges and universities in annual surveys.

Of the 432 seniors in Taylor's class of 2015, more than half of them-239, to be precise-have student debt. The Financial Aid Office calculates Taylor's debt information based on federal loans, including direct, Perkins and parent loans, and private loans the office certifies.

Some students seek to supplement federal loans with direct-to-consumer loans, which may come from banks or other sources and are not certified by Taylor. These are not counted in Taylor's numbers, and Nace said such loans are rare.

Among Taylor seniors with loans, 35 have private loans, and their average debt is $30,222. The parents of 102 seniors have also taken out loans on their student's behalf; average debt among these students is $43,517.

The difference between types of loans is important as repayment rules vary.

Federal direct loans enter repayment six months after graduation-a date coming soon for December and January grads. Parent loans entered repayment as soon as they were disbursed (though parents can defer them while their students are enrolled). Private loans vary but sometimes include deferment options, like their federal counterparts.

To explore the rules surrounding federal loans, Taylor and the federal government require students to complete "exit counseling." Financial Aid Counselor Lyn Kline reminded students that counseling is a graduation requirement in an email sent Thursday to students with loans.

Exit counseling takes about 30 minutes to complete, Kline said (I finished in 27.5), and begins with a dose of reality: the total amount of loans students own. From there, counseling describes the repayment options, their benefits and drawbacks, tells students who their loan servicer (the company managing repayment for the government) is and concludes with requiring students to select one of the repayment options.

Although several options are available, Kline advises students to choose the standard repayment option-which requires 10 years of payments of no less than $50 per month-if possible.

"Whenever you go on a lower payment plan, such as the income-based repayment plan (IBR), that reduces your payments for . . . a certain time period, but then it extends your repayment time," Kline said. "Over the long run, if you stay on that lower payment plan, you're going to pay far more in interest on those loans than you would if you stayed on the standard repayment plan or chose to pay them off early."

To illustrate the difference, consider my loan total of $19,913. According to the Student Loans Repayment Estimator, I would pay $200 per month for 10 years and pay $4,566 in interest on the standard plan.

On the income-based repayment plan, which adjusts payments based on income to cap them at 15 percent of discretionary income, I would pay between $92 and $200 over the life of the loan. The key difference: it would take more than 18 years to pay off my loans, and it would cost me $11,228 in interest.

Kline said a lower repayment plan might be better for students with lower incomes. And if you're struggling to make monthly payments, email her or contact your loan servicer to discuss your options.

"To do nothing is the worst thing," Kline said.

Failing to make a monthly payment on a federal loan makes the loan delinquent, in the federal government's terminology. After 270 days of delinquency, the loans could enter default, which carries serious financial consequences-including late fees, collection or court costs and major damage to your credit score.

Taylor's most recent default rate-the percentage of 2012 Taylor graduates who defaulted on their loans in the last three years-is 3.6 percent. That's well below the national average of 13.7 percent (based on 2011 grads). Nace said Taylor students are generally "conscientious" in ensuring they repay what they owe.

Ultimately, repaying loans comes down to stewardship and making wise choices, Kline said.

"You have lived like a pauper the last four years," Kline said.

It can be tempting to blow the earliest paychecks from your first post-graduate job on all the luxuries college has denied you, Kline finished. Choosing instead to "save, save, save" will help you repay your loans as quickly and cheaply as possible.

So in 22 days, class of 2015, step off the commencement stage onto the path that leads to freedom from student debt. It may be closer than you think.